What Is an ACH NOC (Notification of Change)?

- Ian Berryman

- Aug 7, 2025

- 2 min read

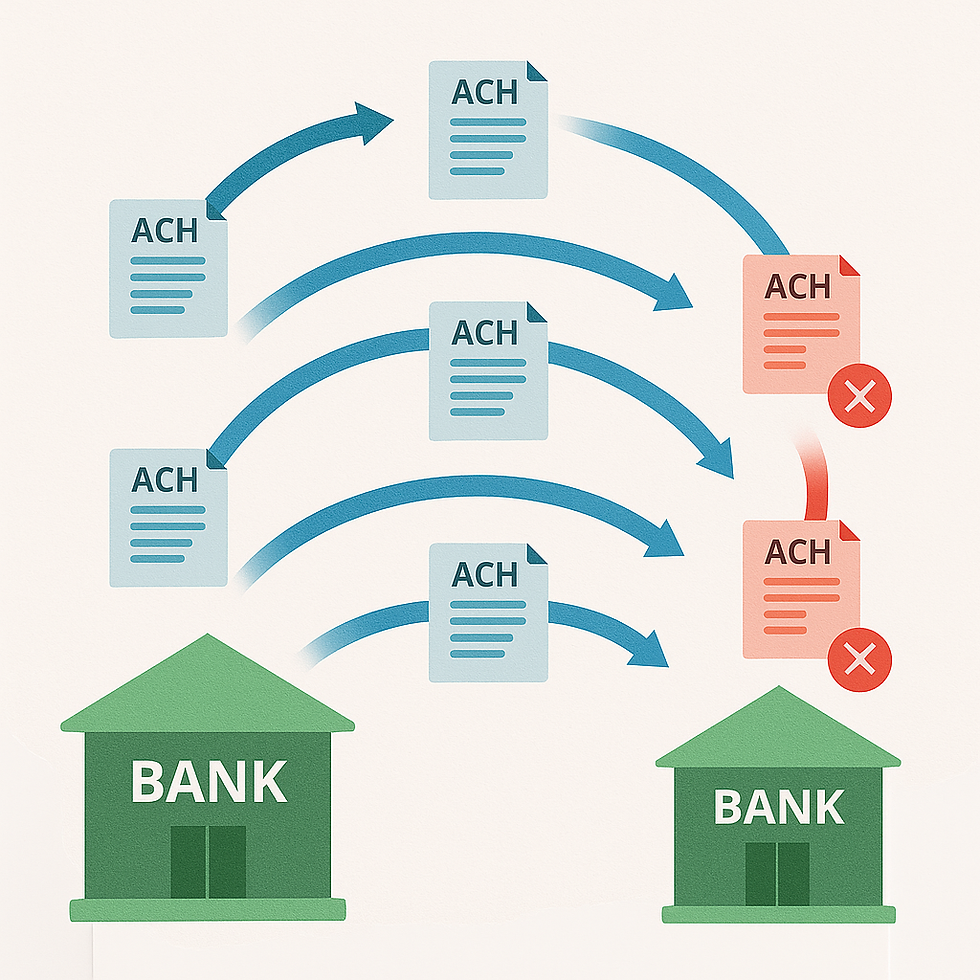

An ACH Notification of Change (NOC), is a type of ACH exception. It is a message from a receiving bank (RDFI) that lets the originator of a transaction know that something in the transaction was incorrect and needs to be changed going foward. Unlike an ACH return which indicates the original transaction failed to post, an NOC indicates that the transaction did post but future attempts may fail if the corrections are not made.

When Do You Receive an NOC?

NOCs are generated by the receiving bank when:

An account number has changed

The account type was incorrect (for example, checking instead of savings)

A routing number has been updated due to a merger

And a few other uncommon reasons

For example: If you sent a vendor payment to a routing number that’s been replaced, the payment might go through, but the receiving bank will issue an NOC with the new routing number for future use.

Common NOC Codes

Here are some common NOC (COR) codes and what they mean:

Code | Description | What It Means |

C01 | Incorrect account number | Use updated account number |

C02 | Incorrect transit/routing number | Use updated routing number |

C03 | Incorrect account number and routing | Use both updated values |

C05 | Incorrect transaction code | Use correct ACH entry type (e.g., checking vs. savings) |

Each NOC will include one or more corrected value.

Tip: ACH Pro automatically parses NOCs provided by your bank and provides clear instructions for how to resolve them.

What Happens If You Ignore an NOC?

Failing to update future transactions can lead to:

Future returns when the correction becomes mandatory

Bank compliance issues for violating NACHA rules

Delayed payments or disruptions

Banks track your compliance with NOC corrections. Consistently ignoring them may flag you as a higher-risk originator.

How ACH Pro Helps Manage NOCs

ACH Pro can help you manage and prevent NOCs by:

Validating routing numbers

Parsing NOCs and providing clear resolution instructions

Updating recipient information

Generating compliant NACHA files so account numbers and types are correctly formatted

Final Thoughts

ACH NOCs are a critical but often overlooked part of ACH processing. They keep payment data accurate across a rapidly changing financial landscape.

If you receive one, don’t ignore it — update your records promptly to avoid future headaches and consider using a tool like ACH Pro to simplify how you manage payments, NOCs, and compliance.

Comments