Modernize Your Bank’s Treasury Offering with ACH Pro

- Aug 7, 2025

- 3 min read

Updated: Sep 8, 2025

Businesses today expect more from their bank than just basic ACH origination. They want tools that are secure, easy to use, and compatible with the systems they already rely on — like QuickBooks and other accounting platforms. Some even want to go beyond fancy user interfaces and need fully automated API solutions. Giving business clients the tools they need to handle payments quickly and efficiently is critical to capturing new business and retaining existing customers.

ACH Pro helps financial institutions modernize their treasury offering by bridging the gap between their clients' needs and the underperforming online banking systems that are holding them back.

Why Treasury Modernization Matters

Whether you're a community bank, credit union, or regional institution, modernizing your treasury tools helps you:

Attract and retain ACH originators (and their deposits and loans)

Reduce back office overhead due to formatting errors and exception handling

Offer value-added tools that compete with larger banks and fintechs

Provide better onboarding and ongoing support

Help clients transition from checks to electronic payments

It's important to remember that business critical services like ACH payments can be deal breakers for potential and existing customers. We regularly talk with customers that are frustrated by their bank's ACH system, many of whom were looking for a new bank when they found ACH Pro. When businesses move their ACH origination to a new bank, they also move their deposit and credit facilities.

ACH is a table stake for business clients, much like mobile deposit is for consumers. It's a product that doesn't generate revenue directly, but helps you build long term relationships that lead to revenue elsewhere in the banking relationship.

Consider this, even if you offered ACH for free, would it be enough of an incentive for your clients to keep using your current system?

What Is ACH Pro?

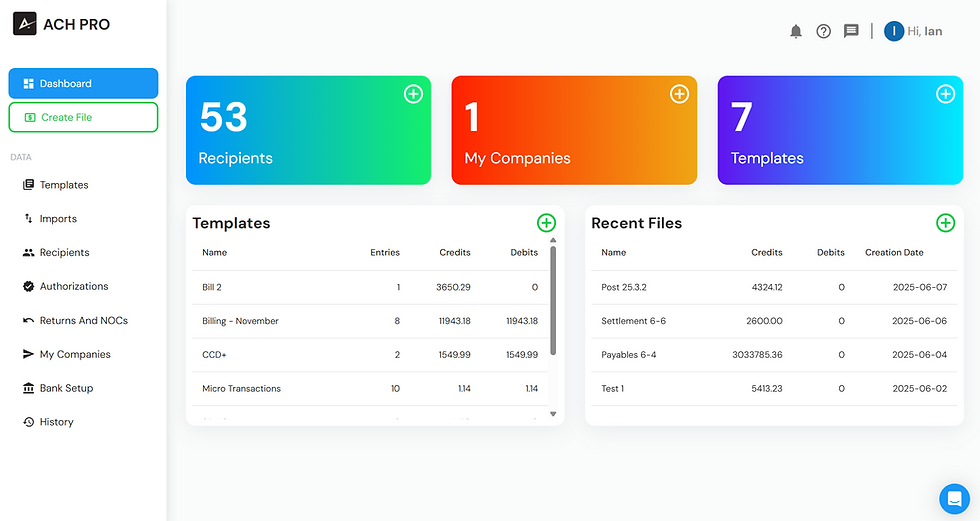

ACH Pro cloud-based ACH software that is designed to complement — not replace — your existing ACH origination platform by improving what happens before the file reaches your bank.

Use this live demo to try ACH Pro yourself.

ACH Pro allows your clients to:

Create NACHA-compliant ACH files (CCD, PPD, CTX, and WEB entries)

Validate file structure and account data

Import payment data from Excel/CSV files

Integrate directly with QuickBooks Online and QuickBooks Desktop

Create and share ACH authorizations

Send remittance emails to recipients

And more...

How ACH Pro Helps Banks Serve Their Clients

1. Reduce ACH Support Burden

ACH Pro allows you to control the format of the NACHA files your customers create so they are always compatible. For customers that continue to create NACHA files from other systems, ACH Pro provides a powerful file validator that you can use to troubleshoot errors (check out the free version here).

2. Simplify Originator Onboarding

ACH Pro gives new originators a guided, error-resistant way to get started. It can be offered alongside your standard ACH onboarding packet or recommended as a best-practice tool.

3. Integrates with QuickBooks Out of the Box

If you're like most financial institutions, you've had customers ask how they can make payments from QuickBooks in online banking. ACH Pro integrates directly with QuickBooks Online and QuickBooks Desktop so your clients can create ACH files using QuickBooks transactions. Their cash flow improves and they save money by originating through your institution, and you retain more deposits that would otherwise be lost to float and processing delays from third parties.

4. Improve Originator Compliance

ACH Pro helps originators stay compliant with NACHA rules by offering robust ACH authorizations and return and NOC management. Rest easy knowing that your originators are collecting authorizations and responding to ACH exceptions in a timely manner.

5. Go Above and Beyond

If you have customers that want to build ACH origination at your institution into their automated workflows, consider yourself lucky that they haven't moved on to a larger institution or a fintech. ACH Pro enables you to offer a full suite of APIs to your clients without the technical overhead. We manage and support the APIs, you handle online banking like normal.

6. Seat-based Pricing, No Transaction Fees

ACH Pro offers a seat-based pricing model so you have full control over your costs and how, and if, you pass them along to clients.

Final Thoughts

Banks that want to stay competitive in today's market can't just maintain the status quo — they must equip their clients with tools that make ACH easy, accurate, and secure.

Want to offer ACH Pro to your treasury clients?

Get in touch with our team to discuss how ACH Pro can help you modernize your ACH offering. We're happy to provide a demo, discuss strategy or just talk payments.

Comments